- The Equity Effect

- Posts

- Exploring Sectors & Growth Stages + When Influence Meets Capital

Exploring Sectors & Growth Stages + When Influence Meets Capital

Capital Currents: Tracking Growth & New Power Players

Overview

"In this issue of The Equity Effect, we break down how capital fuels growth across sectors—tracking real companies from early-stage VC to late-stage investment and beyond. You’ll see how healthcare, fintech, and consumer brands scale with funding, and why HNW investors and influencers are becoming serious players in the game.

What’s inside:

📊 Sector snapshots: Real companies at every stage of growth

🏥 Growth equity in healthcare: Zocdoc, Navina, …

💸 From Seed to Strategic Fit: Simbian

🧴 Early-stage DTC brands: Glossier, Olipop, Allbirds

🚨 Trend alert: HNW + influencer investing on the rise

🩺 Growth Equity Spotlight: Healthcare’s Scaling Giants

Growth equity bridges the gap between early-stage startups, where VCs usually invest, and mature companies that attract private equity. Growth-stage companies are often too mature for early-stage VCs but not yet stable enough for traditional private equity, making them a sweet spot for growth equity investors.

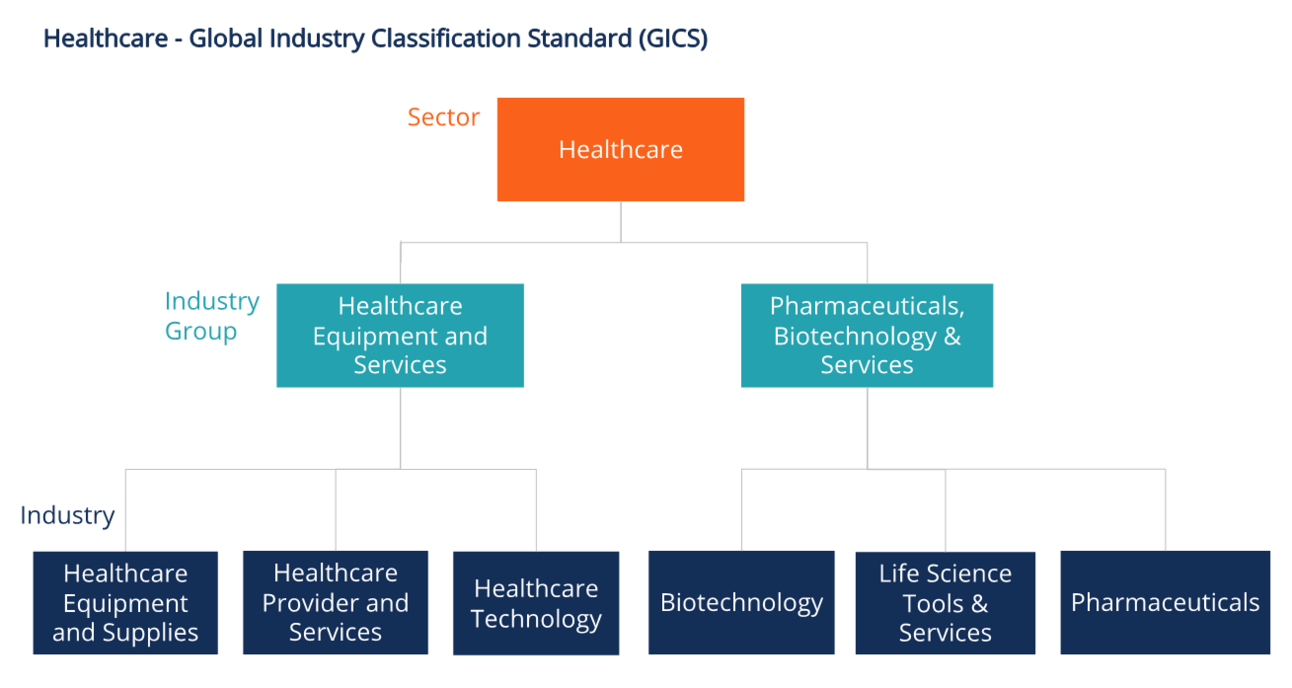

🧠 The healthcare sector is made up of two primary industry groups, with six total industries that fall underneath those. Healthcare equipment, healthcare providers, and healthcare technology fall under the “Healthcare Equipment and Supplies” industry group, as these all relate to providing services to hospitals and the distribution of medical supplies. On the other hand, the “Pharmaceuticals, Biotechnology & Services” industry group has a larger focus on the medicative and biological aspects of healthcare. Growth equity investors often aim to reduce costs by shifting services away from hospitals and toward more scalable outpatient settings. A large challenge that arises during growth equity transactions in healthcare is the differing backgrounds from either party; the investors have a background in finance and not as much healthcare, while the founders of the healthcare firm might not be as familiar with the growth equity model (Reuters). Because of this, it’s important that both parties communicate thoroughly in order to eliminate confusion.

Company highlights:

🏥 Zocdoc: digital healthcare marketplace that allows customers to find doctors’ appointments (both in-person and virtually) based on which providers are in their network and patient reviews. In February of 2021, they announced $150 million of funding from Francisco Partners (PR Newswire).

🧬 Navina: AI copilot aimed at turning patient data into a profile that has insights to alleviate the administrative burden on clinicians, reducing missed diagnoses and improving quality metrics. In March of 2025, they announced $55 million of Series C funding from Growth Equity at Goldman Sachs Alternatives (PR Newswire)

🔐 From Seed to Strategic Fit - Purpose-built Fintech

Some early-stage companies signal long-term value not through explosive growth, but through strategic clarity and operational focus. These are the startups that quietly build the foundations for future acquisition — with products that solve a specific problem, scale efficiently, and slot cleanly into larger ecosystems. We believe Simbian, which raised a $10M seed round in April 2024 at a $40M valuation, is one such company.

Its AI-driven platform addresses a clear need in security readiness by combining automated vulnerability assessments with interactive, user-specific training — creating both technical and behavioral layers of defense. Instead of spreading itself thin, Simbian has concentrated on product depth, measurable outcomes, and enterprise-grade standards from day one. These decisions not only build trust with customers but also position the company well for future strategic interest — the kind of profile that makes early-stage bets attractive beyond just the next round.

“Some early-stage companies signal long-term value not through explosive growth, but through strategic clarity and operational focus”

💄 Early-Stage Consumer Goods: Betting on the Next Big Brand

Glossier: From Seed to Series A

Before Funding | After Series A (Early-stage VC backed) |

Blog-to-Brand Origin (Into the Gloss) | $10M Series A led by IVP in 2014 |

Sold 4 core skincare products | Expanded into beauty + skincare, with 40+ SKUs |

Organic Social Media Marketing | Built a full in-house content + influencer team |

Founder-led operations | Hired seasoned execs to scale marketing/logistics |

Niche Gen Z/ Millennial Consumer Base | Grew into a national cult brand with flagship stores |

💫 Impact of Early-Stage Investment:

Early-stage investment plays a pivotal role in transforming consumer goods startups from niche DTC brands into high-growth companies. Venture Capital funding enables aggressive customer acquisition through paid marketing and influencer partnerships, rapidly boosting brand awareness. It also allows startups to scale operations by investing in inventory systems, fulfillment infrastructure, and experienced hires. With more resources, companies can experiment with retail partnerships, such as launching in Sephora or Target, or explore international markets to test global demand. Altogether, these developments significantly increase a brand’s valuation and position for future funding rounds or acquisition opportunities.

This rise in early-stage consumer brand growth—powered by VC funding, influencer marketing, and direct customer connection—has created the perfect runway for celebrity investors. DTC startups are built for cultural relevance, making them an ideal match for athletes, musicians, and creators looking to go beyond endorsements and take real ownership.

TREND ALERT: High Net Worth & Influencer Investing

Celebs Are No Longer Just the Face — They’re Writing the Checks

It’s not just endorsements anymore. Celebrities are becoming serious players in venture capital—launching funds, joining cap tables, and leveraging their personal brands to accelerate startup growth. Athletes, musicians, and actors are tapping into VC not just for profit, but for access, relevance, and long-term upside.

💰 Why Are Celebrities Getting Into VC?

Built-In Distribution → A celeb’s brand = free marketing. Think Kevin Hart’s Gran Coramino tequila or Kim Kardashian’s SKKY Partners.

Diversifying Wealth → VC offers a high-upside alternative to real estate and endorsement deals. (Ashton Kutcher’s early bets: Uber, Airbnb.)

Front-Row Access to Innovation → Celebs want in before the IPO, not after.

Startups Winning With Celebrity Capital

OLIPOP – Camila Cabello & Joe Jonas backed it; now a $200M+ functional soda brand.

Liquid Death – Tony Hawk & Wiz Khalifa invested early; now valued at $700M+.

F45 Training – Boosted by Mark Wahlberg before its IPO.

Who’s Actually Investing?

Ashton Kutcher (via A-Grade, Sound Ventures): Poppi, Margs, Neighbor, Superhuman. PitchBook profile

Kim Kardashian co-founded SKKY Partners, a Boston-based PE firm focused on consumer and media. But as of late 2024, she’s no longer managing the firm source.

The Jonas Brothers portfolio includes Mindright, Ember, Peels. Link

Mark Wahlberg has backed F45, Unreal Deli, and more—playing both investor and brand partner.

Alix Earle - newly invested into SipMargs in their early funding rounds while also promoting the company as an influencer. Read more here

💡 What This Means for VC

Celebrity investors bring fresh capital, massive reach, and cultural currency. But they also bring volatility. The winners? Consumer brands and fan-driven platforms that can harness the spotlight and deliver results

That’s a wrap on this week’s Equity Effect. As mid-sized markets gain traction in VC, we’re seeing a shift—more capital flowing into overlooked regions and industries, creating fresh opportunities beyond the usual hotspots.

If this issue got you thinking, pass it along to a friend in the space. And if there’s a trend, startup, or deal we should cover, hit us up—we’re always listening.

See you next time,

The Equity Effect

📩 Reach us at: [email protected]