- The Equity Effect

- Posts

- Globalization is Reshaping Venture Capital

Globalization is Reshaping Venture Capital

Regional Shifts Happening as AI Grows

By Claire Johnson, Ahria Desai, Rishika Goteti, and Soledad Perez Leon

Overview

In this issue of The Equity Effect, we unpack how globalization is rewriting the rules of venture capital. From SoftBank’s globe-spanning Vision Fund to the gravitational pull of AI—which now attracts nearly half of all VC dollars—we explore how capital is flowing across borders, sectors, and strategies. You’ll see how U.S. dominance, China’s slowdown, and India’s rise as an AI hub are reshaping the global investment map, and why founders and investors alike need to adapt to this new geography of capital.

What’s Inside:

🌍 SoftBank’s Vision Fund — Billions backing AI and robotics worldwide

🤖 AI at the Center — Nearly half of VC dollars now flow into AI.

📉 Regional Shifts — U.S. leads, China cools, India heats up.

⚡ The Takeaway — Global VC is faster, selective, and interconnected.

Venture Capital is No Longer a Local Club- It’s a Global Arena

Cross-border mega-funds, founders building for global markets, and internationally active investors are redefining how innovation gets financed. From SoftBank’s globe-spanning Vision Fund to AI startups raising record rounds in Silicon Valley, Stockholm, and Bangalore, capital is chasing the most transformative ideas wherever they’re born.

In this issue, we’re exploring how globalization is rewriting the VC playbook:

SoftBank’s Vision Fund: Billions from Riyadh to Tokyo fueling AI, robotics, and autonomous systems worldwide

AI at the center of gravity: Why nearly half of VC dollars now flow into software and AI, across every continent

Regional shifts: The U.S. still dominates, China cools, India heats up as an AI bright spot

The takeaway?

Global VC is fast, interconnected, and more selective than ever. Founders need defensible IP and traction to stand out. Aspiring investors need to understand the new geography of capital to spot the next breakout.

Let’s dive in and unpack the trends shaping this new global era of venture capital.

AI is the Center of Gravity in Global Venture Capital

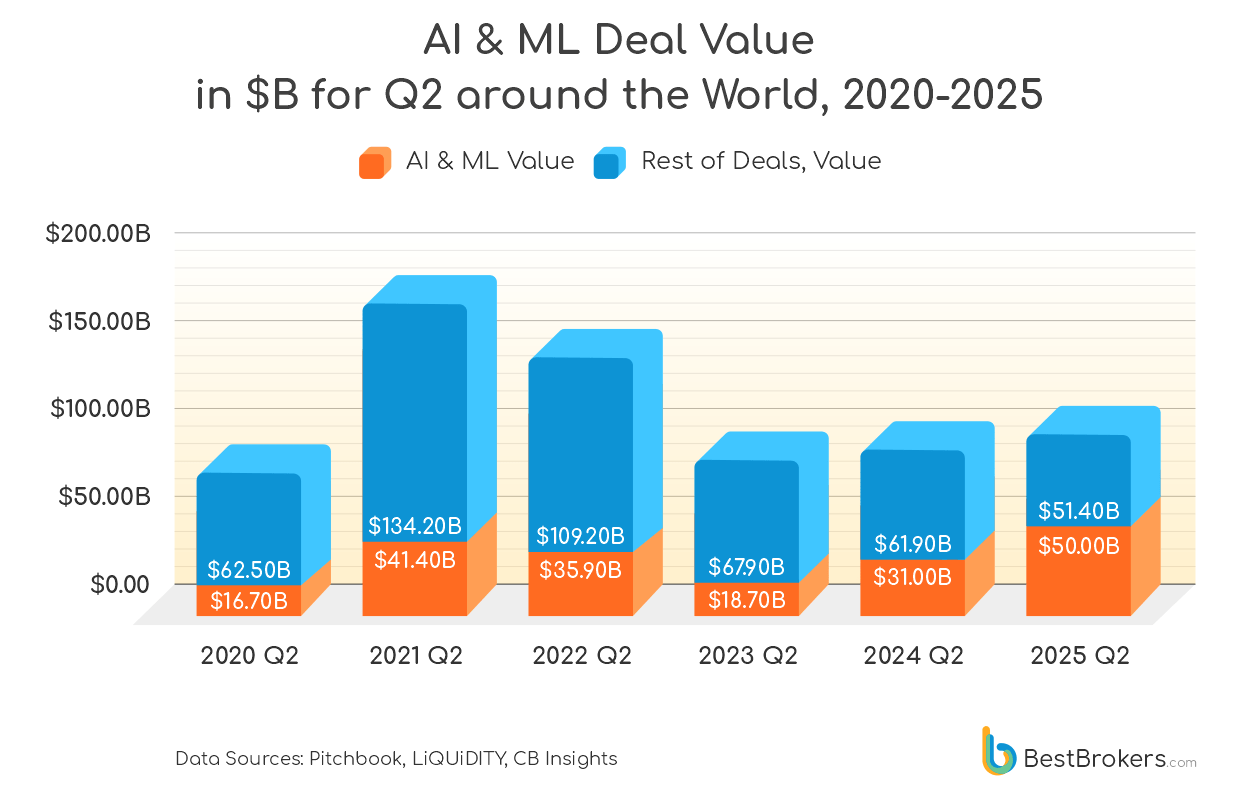

The global venture capital market may be coming down from the 2021 boom where global venture investment hit $643 billion (Crunchbase News) , but one sector continues to grow: artificial intelligence. Software startups are now attracting almost 50% of global venture capital funding, making them the dominant category (Bain & Company). Much of this momentum is coming from a surge in applied AI and generative AI, where investors continue to place record-breaking bets.

Overall global VC investment dropped to around $101 billion in Quarter 2 of FY2025, excluding outside rounds such as OpenAI’s $40 billion raise in Q1(KPMG). What stands out is that AI is carrying much of the ecosystem. Capital is flowing not only into model builders, but also into AI infrastructure, developer tools, and vertical applications. Deals in companies such as Scale AI ($14.3 billion), Anduril ($2.5 billion), and Safe Superintelligence ($2 billion) highlight investors' appetite for technologies that both power and safeguard the next era of AI (KPMG).

Geographically, the US is the epicenter of AI funding, pulling in the majority of large deals and reinforcing its leadership position in the space (Crunchbase News). By contrast, China’s VC market has hit a decade-low, with AI funding dampened by capital pressures and regulatory uncertainty. Meanwhile, India is emerging as an AI bright spot, with increasing investor confidence in both horizontal platforms and sector-specific applications like fintech and mobility.

For founders, the bar is rising. Investors want more than a big vision. They are demanding defensible IP, clear monetization paths, and real traction. For late-stage companies, valuation remains under pressure, but strong AI positioning can still command premium interest. For early-stage teams, seed and pre-Series A funding remains accessible, especially if the startup sits at the intersection of AI and other growth themes like healthcare, cybersecurity, or financial services (Medium).

In short: the venture market may be selective, but AI remains the gravitational pull for global capital. Expect funding to continue concentrating in this sector, even as investors tighten criteria elsewhere. However, this doesn’t come without risk. This creates an increasingly polarized ecosystem where capital pools around a handful of leaders, while smaller AI startups must provide unique niches to survive.

Company Spotlight: SoftBank

SoftBank’s Vision Fund was originally launched in 2017 by Masayoshi Son, the CEO of the firm. It is the world’s largest technology-focused investment fund (WSJ). Unlike many other VC funds, Vision Fund draws capital from a diverse set of global investors. The fund’s original funding round raised $93 billion, some of which came from international investors such as Saudi Arabia’s Public Investment Fund and the Mubadala Investment Company, located in the UAE (ByteBridge).

To support its global reach, the fund consists of managing directors who oversee various global regions, such as Asia, EMEA, and Europe (ByteBridge). Vision Fund’s portfolio engages with companies all over the world, from India’s food delivery company called Swiggy, to Sweden-based payment services company called Klarna, to Chinese ride-hailing platform Didi (CNBC).

The first Vision Fund closed with $98.6 billion in committed capital (ByteBridge). They had successes, but also some failures, such as their investment in WeWork. In November of 2023, the company who offered flexible workspaces of all sizes, filed for bankruptcy. As a result, SoftBank lost over $11.5 billion in equity and $2.2 billion in debt, and cost Son his reputation as a “shrewd investor” (Fortune). The second fund launched in 2019 and has $56 billion in committed capital, with SoftBank being the primary investor. This fund is focusing on artificial intelligence-driven companies.

Vision Fund’s strategy focuses on transformative technologies, such as AI, robotics, Internet of Things and autonomous vehicles. This has been yielding positive results; the fund reported a profit of $2.87 billion in Q2 of 2025, which was the second consecutive quarter of reported profit, a stark contrast from the reported loss in the same quarter a year prior (CNBC). With an increase of 36% in stock value and $37 billion in market capitalization, SoftBank’s Vision Fund shows significant signs of its strong positioning in the global tech investment landscape (CNBC).

Podcast of the Week 🎙️

This podcast episode explores Opendoor’s CEO on tech’s biggest turnaround, plus deep dives into OpenAI, Oracle, and Anthropic’s next moves.

That’s a wrap for this week’s edition of The Equity Effect. As venture capital goes global, AI and mega-funds are redrawing the map of innovation—demanding sharper strategies from both founders and investors.

If this edition sparked new ideas, share it with a fellow founder or investor. And if there’s a global trend, fund, or AI deal you think we should cover, let us know—we’re always tuned in.

See you next time,

The Equity Effect

📩 Reach us at: [email protected]